THE SITUATION

When the owner of this 26 acre farm in West Windsor, NJ found himself physically unable to adequately care for the property and falling behind on mortgage payments due to a long-term illness, he reached out to us for help. By this point, his health had declined to a point where he was living in a hospital bed in his living room with 24 hour home care and had financial and medical POAs in place. The seller knew he had several debts and was concerned that the property may not be worth what he owed but the seller needed to move into an veterans assisted living unit and needed the burden of the property lifted from his shoulders.

WHAT WE DID

With some anecdotal knowledge from the seller and financial POA that the property potentially had multiple mortgages and liens, we knew we had our work cut out for us but were up for the task at hand. And with the seller’s health quickly declining, we knew we needed to act fast. We had listing documents signed and started our pre-listing marketing checklist. At the same time, we contacted a title company partner to do a lien search on a state and federal level. We also contacted the township zoning official, state zoning department and the county and state farm bureaus to determine any requirements of sale and use restrictions. Due to the nuances of this property and the deed restrictions in place (including it’s farmland preservation status), we were aware that the property wouldn’t qualify for conventional loans. We researched lending options to provide to buyers and cooperating agents.

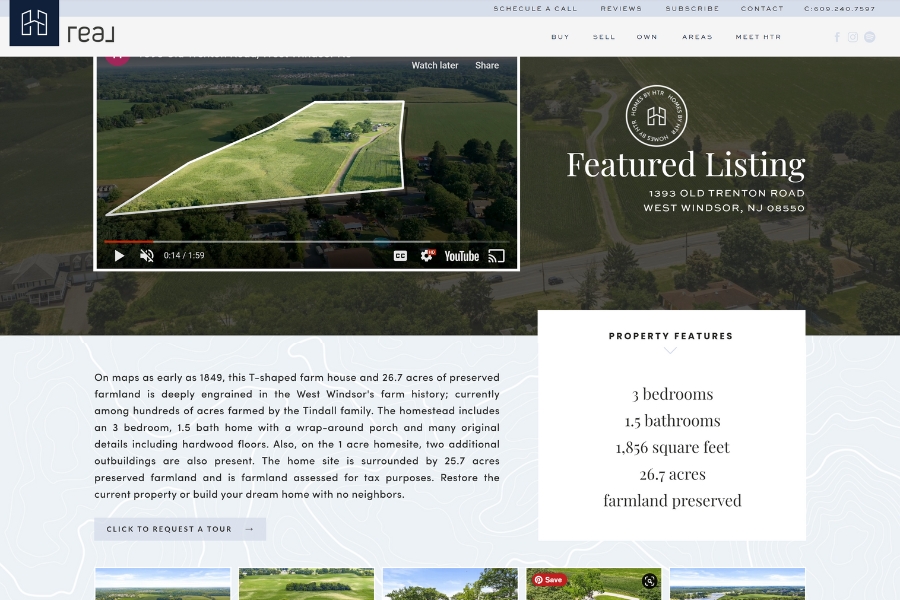

Because of the rare and exclusive nature of this property for the area, our pre-listing marketing preparation included: a comparative market analysis with a private appraisal to ensure the property was appropriately priced; professional photography and videography including aerial footage targeted to showcase the land, the history of the property and the opportunities available to buyers.

We developed our custom listing website and social media ad campaigns to drive additional traffic to the listing. We also coordinated with local, county and state government officials to obtain copies of the survey, Deed of Easement and zoning restrictions to provide to interested parties. The property contained a underground storage tank holding oil and in active use as the heat source. We worked alongside local officials to ensure confirm there would be no issues of deed transfer as the tank was the active heat source. Lastly, we prepared listing entries for the property under multiple categories in the area MLS to expand our reach of potential buyers.

Once the property went active in the MLS and our marketing plan was put into action, we fielded over 150 interest calls in the first week and provided concierge, listing-attended showings to 45+ potential buyers and agents; ensuring the seller stayed comfortable in his home during showings and potential buyers understood the various idiosyncrasies of this unique property. We also verified funding or lending prior to any showing to ensure the potential buyer was qualified to purchase. Our efforts yielded 8 offers in 5 days- many cash, AS-IS purchases. Our first buyer got a case of “cold feet” and we went back to market, quickly multiple offers again; allowing the seller to select a new buyer.

During attorney review, the title searches we ordered returned showing 2 mortgages, 4 federal tax liens and 4 judgements; all of which were delinquent. It became clear that the purchase price agreed upon may not cover all the debts on the home due to legal fees and interest tied to the liens. Because the mortgage totals did not exceed the purchase price, the property was NOT a short sale as liens and judgements don’t count toward a short sale consideration. We renegotiated with the buyer to cover all costs including CO and any legal fees tied to the property, as well as agent commissions, so long as the total cost to purchase did not exceed a new negotiated purchase amount.

THE OUTCOME

Farm properties often take months to receive an contract and years to close. We successfully placed this property in attorney review twice within 23 days of listing, under contract within 4 months (allowing the attorneys time to do diligence on several items including liens) and closed on the property within 75 days of going under contract. The seller was able to move into his assisted living unit 2 months after listing the property; knowing his home for nearly 20 years was on it’s way to new owners. And we successfully lifted the burden of the property off his shoulders, closing 10 days prior to his passing.

SERVICES WE PROVIDED

- Equity Assessment and Comparative Market Analysis

- Recommendation and scheduling of a Private Appraisal*

- Robust marketing plan including custom listing website and digital advertising

- Title Search and Research*

- Research and coordinated with local, county and state officials to appropriately define and disclose use restrictions

- Researched available lending options due to property’s non-qualifying attributes for conventional loans

- Confirmed conveyance options with local officials for the active use underground storage tank

- Verification of qualified funding for all showings prior to tours

- Concierge showings with the listing agent present for all tours

- Reviewed title searches to confirm total mortgage, lien and judgement count

- Recommendation for legal council to represent the seller

- Worked alongside legal council and agent to renegotiate

+ show Comments

- Hide Comments

add a comment